Suppose you have a $10 Canadian bill. The value of this bill goes up and down relative to other currencies, like USD, EUR, and CNY. For example, a $10 Canadian bill might be worth around 7 USD, depending on the current exchange rate. You can trade on this information by speculating on the stronger currency (the US dollar) against the weaker one (the Canadian dollar) to try to make a profit.

As a beginner forex trader, you must first learn what is forex before learning how to trade and make money. In this beginner-friendly guide, I will explain “What is forex trading” and how to start as a beginner so that you can confidently place your first trade.

What Is Forex Trading? 10 Key Terms + Examples

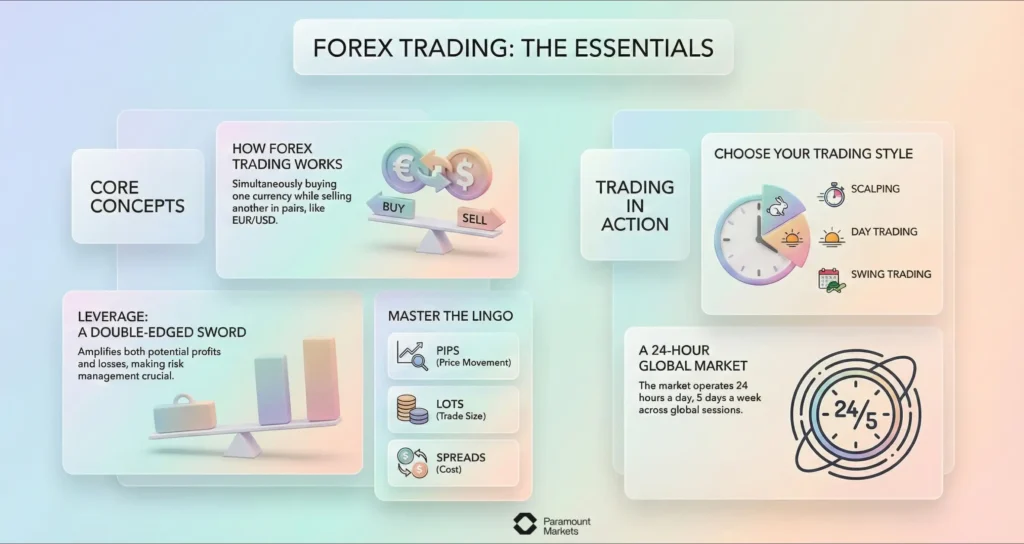

A solid understanding of the fundamental concepts of forex trading and the market dynamics is essential for anyone looking to enter this market.

Here are some of the key terms you should know:

1. What Is Forex Pair?

In forex, currencies are traded in pairs. Another way to think of it is that each currency is worth a certain amount against another currency.

For instance, in the currency pair EUR/USD, the euro (EUR) is the base currency, and the U.S. dollar (USD) is the quote currency. So if EUR/USD is quoted at 1.20, it takes 1.20 U.S. dollars to buy 1 euro. Currency traders buy or sell a currency pair based on how they think the two currencies will change in value relative to each other.

Types of Currency Pairs

There are four types of pairs in forex currency trading:

| Pairs | Description |

|---|---|

| Major | The seven main currencies of EUR/USD, USD/JPY, GBP/USD, USD/CHF, USD/CAD, and AUD/USD that are heavily traded. |

| Minor | Less often traded currencies, like EUR/GBP, EUR/CHF, and GBP/JPY |

| Exotics | A major currency vs a currency from a minor or developing economy, like USD/CZK. |

| Regional | Pairs that are categorized by areas, like NOK/SEK. |

2. What is a Pip in Forex Trading?

A percentage in point, commonly referred to as a pip, is the smallest price movement in a currency pair.

For most currency pairs, a pip is usually the fourth decimal place (0.0001). For example, if EUR/USD moves from 1.2000 to 1.2001, it has moved one pip. Pips are important because they are used to measure price changes and calculate profits or losses on trades.

3. What is a Lot in Forex Trading?

A forex lot refers to the size of a forex trade. There are three main types of lots in forex trading:

- Standard Lot: 100,000 units of the base currency.

- Mini Lot: 10,000 units of the base currency (1/10th of a standard lot).

- Micro Lot: 1,000 units of the base currency (1/100th of a standard lot).

For example, if you buy one standard lot of EUR/USD, you are buying 100,000 euros.

4. What is the spread in forex trading?

The spread in forex trading refers to the difference between the bid price and the ask price of a currency pair. The bid price is the price at which you can sell a currency, and the ask price is the price at which you can buy it.

For instance, if the EUR/USD bid price is 1.1990 and the ask price is 1.2010, the spread is 20 pips. Spreads can vary depending on the market conditions and the broker and are essentially the cost of trading.

5. Leverage in Forex Trading

Leverage in forex trading is a tool that allows traders to control a larger position with a smaller amount of capital. It works by using borrowed funds from the broker.

For example, if a broker offers a leverage of 100: 1, it means that for every $1 of your own money, you can control a position worth $100. If you want to control a position worth $100,000, you will only need $1,000 of your own capital.

Leverage can amplify both profits and losses, so it’s important to use it wisely and with caution.

6. Margin in Forex Trading

Margin in forex trading is the money that you need to open and maintain a position. It’s essentially the good faith money that you deposit with your broker to trade. Margin is usually expressed as a percentage of the total trade size.

For example, if you want to open a position worth $100,000 and your broker’s margin requirement is 1%, you would need to have $1,000 in your trading account to open the trade.

It’s important to understand margin requirements because if your trade moves against you and you don’t have enough margin to cover the losses, your broker can issue a margin call, and you will have to deposit more funds or close the position.

7. Liquidity in Forex Trading

Liquidity in forex trading refers to how easily a currency can be bought or sold in the market without significantly affecting its price.

In forex, major currency pairs such as EUR/USD, USD/JPY, and GBP/USD are considered highly liquid. When I say that it is “highly liquid” I mean:

- Trades can be executed quickly

- There’s minimal price slippage

- Lower transaction costs

- Easier entry and exit from positions

For example, the EUR/USD pair is very liquid because it involves two of the most traded currencies in the world. High liquidity is important for traders as it allows them to execute trades at their desired prices and makes it easier to manage risk.

8. Volatility in Forex Trading

Volatility measures the rate and magnitude of price changes in a currency pair. It represents the potential for significant price movements within a given time frame. The measure has the following main characteristics:

- Indicates potential trading opportunities

- Reflects market uncertainty

- Varies across different currency pairs

- Influenced by economic events, political situations, and market sentiment

For example, emerging market currencies such as the Turkish Lira or the Argentine Peso tend to be more volatile than stable currencies like the Swiss Franc or the US Dollar.

Traders can use volatility to formulate specific trading strategies such as range trading or breakout trading (more on this later).

High liquidity often correlates with lower volatility

9. What are Forex CFDs?

Forex CFDs (Contracts for Difference) are financial instruments that allow traders to invest in the price movements of currency pairs without actually owning the underlying currencies.

“A CFD, as the name suggests, is a contract between a trader and a broker.”

The contract trades the difference in the price of an asset from the time the contract is opened to when it is closed.

Simply put, you are investing on whether the price of a currency pair will go up or down. You do not own the underlying currencies; you trade the price difference

10. Bid in Forex Trading

Bid price is the highest price a buyer is willing to pay for a currency pair. The buyer is usually a broker or a market maker. It is also the price you can sell a currency pair.

How Does Forex Trading Work?

Forex trading (foreign exchange trading) is the act of buying and selling currencies with the intention of making a profit from changes in their relative values (exchange rate – the number of the quote currency needed to purchase one unit of the base currency).

Forex is always traded in currency pairs. This simply means that you are buying one currency and selling another at the same time. The key to forex trading profit lies in selling a currency you believe will decrease in value while buying another currency anticipated to increase in value.

The trading itself is generally done through online forex brokers. These forex brokers offer trading platforms through which you can access the forex market. A trading platform will show you current exchange rates and allow you to place orders.

How to Make Money with Forex Trading?

After you have selected the two pairs you will trade, you are ready to make a profit by either buying or selling these currencies. Here is how it works:

You buy the pair if you believe it will rise in value against the quote currency. It is known as Going Long.

You sell the pair when you believe it will lose value or weaken against the quote currency. It is called Going Short.

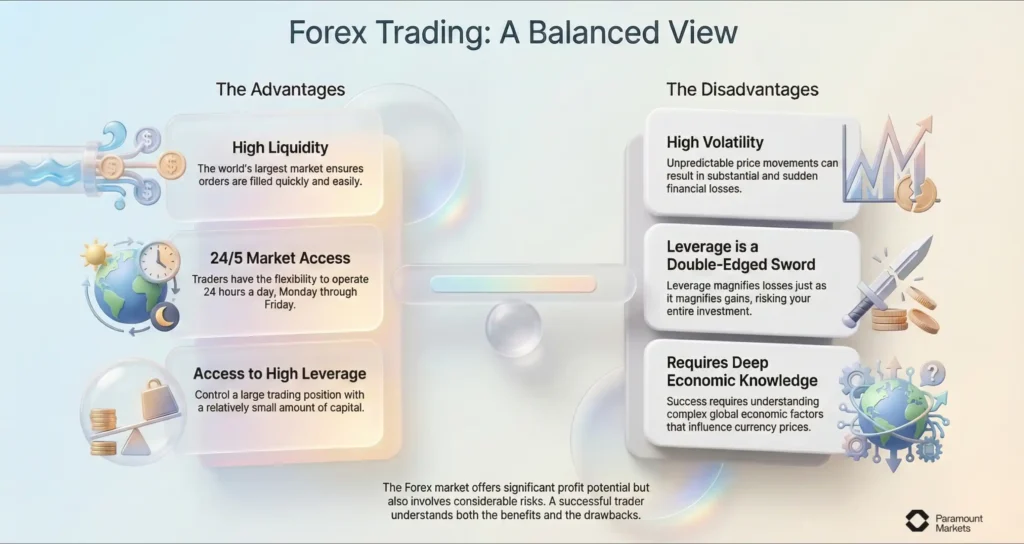

Why Trade Forex?

Trading on the Forex market has a great potential to earn a large profit. However, the market also has considerable risks involved.

If you take the time to understand the below factors, develop a well-thought-out trading strategy and a risk management plan, you will be on your way to becoming a successful forex trader, and also be able to avoid the risks involved.

Advantages of Trading Forex

High Liquidity

The forex market is the largest and most liquid market in the world, with daily volumes of trillions of dollars.

This liquidity means that your orders can be filled quickly and easily, even during periods of high volatility, with low slippage (the difference between the price you expect to pay and the price at which your order is actually executed).

24/5 Access

Traders have the flexibility to operate at any time because the forex market remains open 24 hours a day Monday through Friday.

Leverage

Forex brokers offer high leverage, which means that you can control a large position with a relatively small amount of capital.

Low Transaction Fees

Transaction fees in forex trading are generally lower than in other financial markets. Plus, many brokers, like us, don’t charge commissions (on standard account). Instead, they make their money on the spread.

Wide Accessibility

Online trading platforms have opened up forex trading to all types of traders across the globe.

Unlimited Trading Options

The market offers a wide range of currency pairs, which means you can choose the pairs that best suit your trading strategies and risk tolerance.

Disadvantages of Trading Forex

- High Volatility: Price movements tend to be unpredictable which can result in substantial financial losses.

- Leverage Risk: Leverage can magnify both gains and losses. A small adverse price move can lead to substantial losses or wipe out your initial investment.

- Required Amount of Economic Knowledge: Forex trading requires an understanding of various domestic and global economic factors that influence currency prices. Therefore, as a beginner trader, you need to develop a good knowledge base of the factors that can influence prices and the dynamics of the market.

Risk Management in Forex

Managing risk is a critical aspect of forex trading. These 10 forex risk management techniques can help you better handle trading risks.

1- Set Stop-Loss Orders:

Place stop-loss orders at a reasonable level based on your risk tolerance and market volatility to limit potential losses.

2- Position Sizing

Determine the appropriate position size to risk a certain percentage of your trading capital on each trade. A general guideline is to risk no more than 1-2% of your trading capital on any single trade.

3- Use Leverage Wisely:

Leverage can amplify both profits and losses. Use leverage judiciously and avoid excessive leverage.

4- Diversify Your Trades:

Invest in different currency pairs to spread your trade risks. Avoid concentrating too much of your capital in a single currency pair, as this can expose you to greater risk.

5- Seek a Favorable Risk-Reward Ratio:

The objective should be to select trades which offer greater potential profits compared to their potential losses. A common target is a risk-reward ratio of 1:2 or higher.

6- Have a Trading Plan:

Develop a comprehensive trading plan that includes your risk management rules, trading strategies, and goals.

7- Stay Informed:

Keep up to date with economic news, political events, and market trends that can affect your trades.

8- Maintain a Trading Journal:

Record your trades, the reasons for entering the trade, and the outcome in a trading journal. This will help you to review your performance and identify areas for improvement.

9- Control Your Emotions:

Emotional trading can be very risky. Learn to control your emotions and stick to your trading plan.

Who trades Forex?

The forex market is an open ecosystem with a wide range of participants. A wide variety of entities from individual traders to huge financial institutions and corporations. The sum of their individual actions make up the market as a whole.

Here is a list of the primary participants in the forex market:

Retail Traders

Individual investors participate in forex market trading using online broker platforms. They trade with the primary goal of generating profit from movements in exchange rates.

Institutional Investors

These are financial institutions that trade currencies in large volumes and usually have a significant impact on the forex market. These include banks, hedge funds, corporations, and central banks.

How to Trade Forex? A Step-by-Step Guide

Although the detailed guide about how to trade forex explains all the steps and information you need to know to trade forex, below is a quick summary of the key steps to trade forex:

Choose Your Broker

The single most important thing for a successful trade, and a most undervalued for retail traders and newbies in forex, is the choice of the broker. Your broker should be trusted as ParamountMarkets, a firm that provides the following important features:

- Transparency about all fees and related charges.

- Competitive pricing- low spread(the difference between the buy and sell price).

- Reliability.

- Easy integration.

- Stable, user-friendly, trading platform equipped with essential tools for analysis and order execution.

- Fast and reliable order execution.

- Segregated accounts to keep client funds separate from their own operating funds.

- Compensation schemes.

Open an account

Complete the application form by providing your personal information and validate your identity to create your free account today.

Deposit Funds

After your account is approved, you can deposit funds into your account using one of the available deposit methods, such as cryptocurrencies, bank transfers, credit/debit cards, and e-wallets.

Pick a Trading Strategy

For successful forex trading, you need a well-crafted trading strategy, such as:

- Scalping

- Day Trading

- Swing Trading

- Position Trading

- Price Action Trading

- News Trading

Execute a Trade

Log in to your trading platform and select the currency pair you want to trade. Based on your analysis, decide whether you want to buy or sell the currency pair, choose your order type, enter the trade size, and confirm the order.

Monitoring

Keep an eye on your open positions and monitor their performance. Adjust your stop-loss and take-profit levels as necessary. Stay updated on market news and events that may impact your trades.

When to Trade Forex: Understand Forex Trading Sessions

One of the most important things you should understand when trading Forex is forex trading sessions. The Forex market is open 24 hours a day, five days a week, but not all hours are the same in terms of activity levels.

Forex trading sessions are determined by the time when major financial centres across the world open and close for business. As a rule, each of these centres is busiest when it’s open and quietest when it’s closed.

Sydney Session

The Sydney session is the first trading session of the day and is typically the least volatile of the day. It’s a good time to observe early trends.

Tokyo Session

The Tokyo session is the Asian session and is centred around Tokyo. This period marks the peak trading time for currency pairs such as USD/JPY in Asian markets.

London Session

It is the European session and is considered the most active. High liquidity and volatility are typical of this session, and many major currency movements occur during it.

New York Session

The North American session with significant activity, especially when it overlaps with the London session. US economic news releases frequently cause unpredictable price behavior in markets.

What is a Forex Trading Strategy?

A forex trading strategy comprises specific guidelines and rules that direct a trader’s actions when they trade currencies. It is a step-by-step plan that helps them make trading decisions based on logic and analysis, rather than emotion and intuition. A trading strategy will tell you precisely what you need to be looking for in the market.

For example, when should you buy or sell a currency pair, and when should you close your position and take profit or cut your losses?

A good trading strategy also has rules for risk management, such as how much to risk on each trade, where to place stop-loss orders, and how to adjust them if the market moves against you.

Why Do You Need a Forex Trading Strategy?

A defined and tested strategy is of the utmost importance when trying to find success in Forex. Strategies also allow traders to manage risks better and keep emotions out of decision-making. They help by:

- Providing discipline and preventing impulsive trades.

- Providing clear and consistent rules for entry and exit.

- Allowing the trader to analyze and learn from their trades

Type of Forex Trading Strategies

Having a strategy is one of the essential steps for forex beginners to follow in order to help you know when and how to trade. Various types of approaches and strategies can be implemented, as seen below:

Short-term Trading

The strategy is generally focused on profiting from small price changes in a short period. Scalping and Day trading are types of short-term trades.

Scalp Trades

It is the fastest form of trading, and traders usually look to make profits from the very small price movement that can be held for a few seconds to a few minutes.

Day Trades

Day traders close all the positions at the end of a trading day. This strategy is also not recommended for new traders as they make all their profit in one day, where the traders profit from the intraday price change.

Swing Trades

Traders hold their position from a few days to even a few weeks with the intention of profiting from the larger price swing.

Position Trades

Position traders are the ones that hold positions for the longest time; from a few weeks, a few months, and even years. They focus mostly on long-term trends and are less involved with technical analysis and more with fundamental analysis.

News Trading

This trading strategy is all about economic news releases and geopolitical developments; many events throughout the day can influence traders to take a particular position to make a profit from the price movements and volatility following the different news announcements.

Price-action Trading

Price-action Trading is a forex strategy that is based on analyzing price charts and patterns for possible trades.

Traders that use this strategy heavily focus on the pure price movement and rarely use technical indicators and technical analysis.

What are the Different Types of Forex Markets?

Forex trading, also known as foreign exchange trading, is the process of buying and selling currencies in order to make a profit from the changes in their exchange rates. While the concept of trading currencies may seem simple enough, there are actually different types of forex markets, each with its own characteristics.

Let’s take a closer look at the main types of forex markets:

1. The Forex Spot Market: Immediate Exchange

The spot market is where currencies are bought and sold for immediate delivery. “Immediate” in this case typically refers to a time frame of two business days.

When trading on the spot market, traders buy or sell currencies at the current market price, which is referred to as the “spot rate”. It is the most common and well-known type of forex trading.

2. The Forex Futures Market: Standardized Contracts for Future Delivery

The futures market is where standardized contracts are traded that require the buyer to purchase (or the seller to deliver) a specific currency at a predetermined price and date in the future. Futures contracts are traded on organized exchanges, such as the Chicago Mercantile Exchange (CME).

3. The Forex Forwards Market: Customized Contracts for Future Delivery

The forwards market is similar to the futures market in that it involves trading contracts for future delivery. However, forwards contracts are customized agreements that are negotiated directly between two parties, typically banks or corporations.

Forwards contracts are not traded on organized exchanges, so they are considered to be over-the-counter (OTC) instruments.

Key Factors to Monitor as a Forex Trader

As a Forex trader, you need to keep an eye on a variety of elements that influence currency prices and movement.

These components include economic data like GDP growth in addition to political and geopolitical events together with central bank interest rates, commodity costs and market sentiment.

How Is Forex Trading Different from Other Types of Trading?

Forex trading stands apart from stock and commodities markets due to several distinct characteristics.

- Working hours,

- Highest level of liquidity,

- Global Impact,

- Higher leverage,

- Decentralization,

- Currency pairs are traded.

How to Become a Forex Currency Trader?

Now that you know the basics of the forex market and understand how forex trading works, it is time to start your journey at one of the most reliable brokers out there, ParamountMarkets.

With the user-friendliest trading platform, zero hidden fees, transparent charges, competitive prices, and reliability, ParamountMarkets is the ideal choice not only for the beginner retail traders, but also for every trader looking for a trusted broker to work with.

Do not miss a chance and create your free account today.

Last Few Words

In this guide, I have shown my experience in the forex market. I have gone over everything, from answering “What is forex trading”, to understanding the basic terms and market structures, how to keep up with the trading sessions, and how to manage your risks.

Forex trading is no exception to the rule that any success starts with knowledge, discipline, and, of course, practice.

Starting a journey into the world of forex trading is an exciting and very doable experience for new traders who remember the golden rules of continuous learning, starting with a reliable broker such as ParamountMarkets, and, most importantly, sticking to good risk management.

Why not give it a shot and start today?

FAQ

Is forex trading gambling?

No. The idea of trading is similar to gambling because, in both scenarios, you bet on an outcome and must avoid risking more than you can afford. But trading, unlike gambling, involves extensive planning and implementation of strategies, allowing you to profit.

Is Forex Trading Halal?

Yes. Forex trading is not gambling. So, it is not considered forbidden by Islamic practices.

Can I trade forex with $100?

Yes. With leverage provided by top forex brokers, like ParamountMarkets, you can control larger positions with a smaller amount of capital, say $100.

Disclaimer: The information provided in this article is for educational and informational purposes only and does not constitute financial advice, investment recommendations, or an offer to buy or sell any financial instruments. Trading Foreign Exchange (Forex) and Contracts for Difference (CFDs) involves a high level of risk and may not be suitable for all investors. Leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite. You should not invest money that you cannot afford to lose.