Forex trading offers huge profit potential, but only if you master the mechanics and strict risk management. While the initial stages may seem intimidating, having the right roadmap changes everything.

This how to trade forex guide is designed to cut through the noise and help newcomers start trading confidently. From selecting the best currency pairs and executing strategies to avoiding rookie mistakes, I will walk you through the practical steps you need to place your first profitable trade.

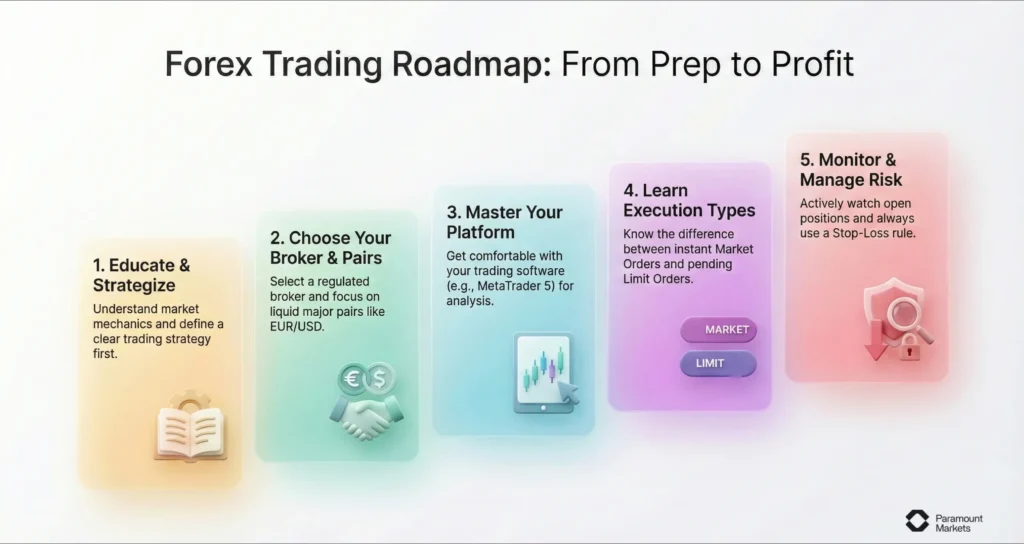

How to Start Forex Trading in 8 Simple Steps

Understanding how to trade forex involves recognizing that you’re dealing with currency pairs, and aiming to predict whether one will increase or decrease in value relative to the other.

To help you navigate this market, I put together the following step-by-step forex trading guide to take you from forex trading basics, through the selection of a broker, to finally placing your successful first trade. While there are infinite resources out there, this easy-to-understand forex trading tutorial for beginners is all you need to get started today.

Step 1: Learn about the Forex Market

Knowledge is power and you are doomed to lose money trading if you fail to learn the trading basics and related information.

Forex trading is not gambling and having lady luck on your side will not guarantee a profit. So, you must ensure to learn everything properly before placing your first ever trade. Here is a checklist of concepts for forex trading for novices:

- Understanding the mechanics of forex market

- Understanding the currency pairs and their relationship

- Learning the different forex markets and how each market works

- Basic trading concepts

- Learning how to analyse the market using basic and advanced technical analysis and fundamental analysis.

- Learning trading strategies and selecting the best strategy

- Practicing proper risk management

- Learning discipline and personal emotional control

You can learn all of the above plus more valuable insights about the forex market in my comprehensive beginner’s guide on What is forex and what is forex trading guides.

Step 2: Decide How You Want to Trade Forex

There are many ways to trade forex, each with its own features and advantages. The right approach for you will depend on your trading style, goals and skill level. It’s important to understand the different methods available before choosing one for your forex trading.

Forex CFDs

CFD stands for Contract for Difference. A CFD is a financial derivative, which means it’s a contract between two parties based on the value of an asset.

A contract for difference (CFD) is a popular financial instrument that lets traders speculate on the price movement of an asset without actually owning it.

A CFD is a contract between a trader and a broker. The two sides agree to exchange the difference in the price of an asset between the time the contract opens and the time it closes.

Instead of buying and selling the underlying asset (stock, commodity, etc. ), traders speculate on whether its price will rise or fall.

Here there will be two scenarios:

- If you believe the price will rise, you “go long” (buy).

- If you believe the price will fall, you “go short” (sell).

A key feature of CFDs is that traders never take ownership of the underlying asset.

In other words, you are simply trading the price movement which eliminates the need for physical delivery or storage of the asset.

The profit or loss is determined by the difference between the opening and closing prices of the CFD. If your prediction is correct, you make a profit. If your prediction is incorrect, you incur a loss.

Understanding Leverage in CFDs

CFDs often involve leverage, which allows you to control a larger position with a smaller amount of capital which is called “margin”. The risk of losing your capital is increased as is the possibility of a larger profit. But losses can exceed your capital also!

CFDs grant you access to a broad range of markets such as forex, stocks, indices and commodities, all from a single trading platform.

CFDs in a nutshell offer an easy to use and simple platform to trade on price movements without all the complexity of owning the underlying assets directly. For this reason, CFDs are by far the most common and accessible way for retail beginners to trade.

FX Options

FX Options are simply options for trading currency pairs. An FX option gives you the right, but not the obligation, to buy or sell currencies at a certain price (called the strike price) at a certain time.

You pay a premium for this right. Think of it like a deposit on a future transaction, but you can walk away if you want.

There are two common types of FX options:

- Call Option: Gives you the right to buy a currency at the strike price.

- Put Option: Gives you the right to sell a currency at the strike price.

While FX Options are more complex and less common for absolute beginners, CFDs are the best choice for beginner forex traders.

Step 3: Prepare a Trading Plan

A trading plan is like a road map for your trading activities. When you follow a plan, trading is more like a business than a gamble. A good plan can also help you to trade without emotion.

- Decide what you want to achieve from trading (eg. regular income, capital growth or an overall percentage return).

- Work out how much risk you can afford to take without it upsetting you emotionally, so that your trading doesn’t threaten your financial security.

- Choose currency pairs and markets that suit your personality and the time you have available to trade.

- Develop your approach using one of these common trading strategies:

- Short-term strategies: Day trading and Scalping which mainly focus on quick trades to capitalize on small price movements.

- Mid-term strategies: Swing trading, which involves holding positions for several days to capture medium-term trends.

- Long-term strategies: Position trading, where trades are held for weeks or months based on longer-term market trends.

- Maintain a trading journal to record every trade you make and analyze your performance by documenting your entry and exit points, the reasoning behind your trades, and your emotional state during the trades, which can help you identify patterns and make more informed decisions in the future.

- Test your strategies on historical data to see how well they would have performed in the past by using backtesting, which is a process of simulating your strategy on past market data and evaluating its potential profitability and risk.

- Practice your strategies in a simulated environment using virtual money(use demo accounts).

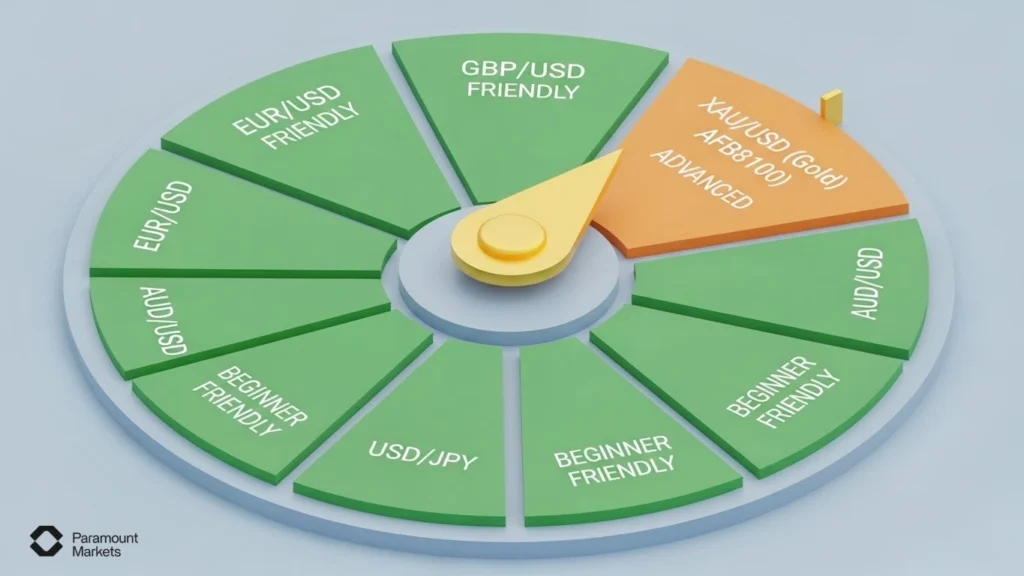

Step 4: Decide on Your FX pair to Trade: What Pairs to Trade?

Major pairs are the best to trade for beginner currency traders as they have the most liquidity and easiest to trade. You may want to start with gold, which is the XAUUSD, but I do not recommend that as gold trading requires more advanced trading skills.

So, the best pairs to trade for beginners are:

- EUR/USD

- GBP/USD

- EUR/GBP

- USD/CAD

- USD/JPY

- USD/CHF

- AUD/USD

- NZD/USD

Step 5: Choose a Reliable Forex Broker

Selecting a reliable Forex broker is essential for a secure and smooth trading experience. Here are the important criteria to consider when choosing your broker:

- Broker’s reputation,

- Platform quality,

- Fast and reliable order execution,

- Fair spreads and charges,

- Transparent fees,

- Reliable customer support,

- Variety of deposit and withdrawal options,

- Minimum deposit requirements,

- Diversity of trading accounts and currency pairs.

ParamountMarkets is the ideal choice for forex trading for beginners as well as experienced traders. With Zero fees, ultimate user-friendly platform, a vast variety of currency pairs to trade, and many more perks, ParamountMarkets is the broker you need.

Step 6: Open Your Trading Account at ParamountMarkets

Now is the time to sign up and create your trading account. Fill in the online application and provide the requested personal information. Then, you need to verify your account and identity.

Once you are verified, you can fund your account using the many supported options available. Last but nor least, you should choose a trading platform and connect your account to it. But how to choose the right trading platform?

Here is how:

Features to Look for in a Trading Platform

A trading platform is a portal through which you can view market information, exchange funds and place orders. In other words, a trading platform is like a cockpit from which you can control your operations.

Here are some of the key features that you should look for in a trading platform:

- Advanced Charting Tools(Variety of chart types, Extensive library of technical indicators, Time frame variability),

- Real-Time Data and News,

- Order Execution Capabilities(Fast and reliable order execution, Variety of order types),

- Risk Management Tools(Stop-loss and take-profit orders, Position sizing calculators),

- Customization,

- Alerts (Price alerts, and indicator alerts).

What is the Best Trading Platform?

MetaTrader 5 (MT5), the platform that we use at ParamountMarkets, is widely recognized as a powerful and versatile trading platform that caters to traders of all levels. While it is quite beginner-friendly, its advanced features, like what explained above, make it ideal for experienced traders, too.

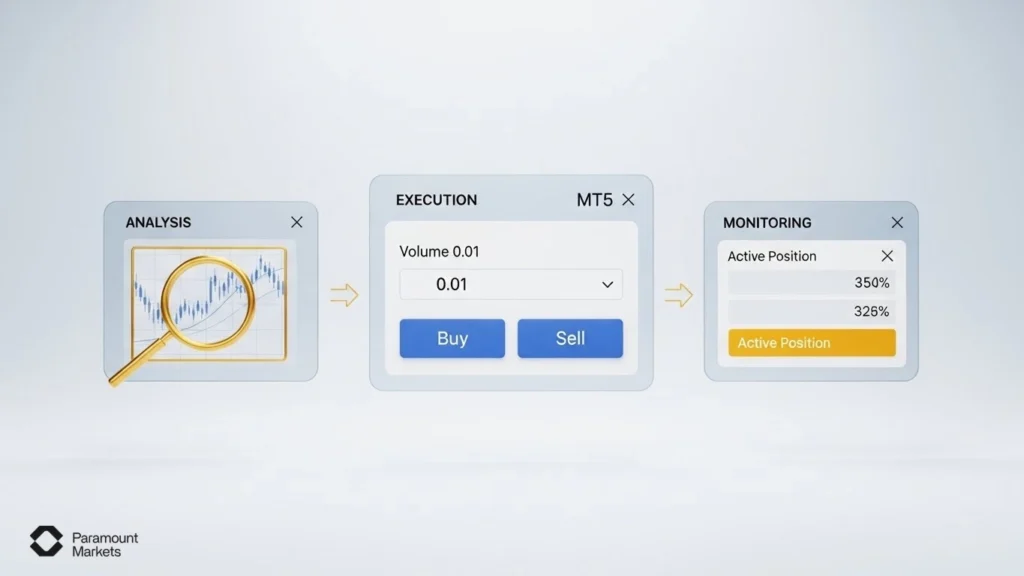

Step 7: Place Your First Trade

There are two main order types in Forex trading, market orders and limit orders:

- Market order: The simplest type of order. You are instructing your broker to buy or sell a currency pair at the current market price. This order is typically used when you want to enter a trade right away.

- Limit order: With a limit order, you can specify the price at which you want to buy or sell.

This type of order is used when you want to enter a trade at a more favorable price than the current market price.

The most common limit orders are:

- Buy Limit: An order to buy a currency pair at a specified price or lower. The order will only be executed if the market price reaches your specified price.

- Sell Limit: An order to sell a currency pair at a specified price or higher. The order execution depends on the market price achieving the specified price.

How to Execute Your First Forex Trade (Using MT5 as an Example)

- Log in to your MT5 account and open the chart for your desired currency pair.

- Choose the currency pair for trading such as EUR/USD and GBP/JPY.

- Use either technical or fundamental analysis to decide your next trading move whether it involves buying or selling.

- Open the order window by Clicking the “New Order” button, right-clicking on the chart and selecting “Trading” -> “New Order,” and pressing F9.

- Choose “Market Execution” if you want the trade to open immediately at the current market price. Choose “Pending Order” if you want the trade to trigger only when the market reaches a certain price.

- Enter the volume of the currency you want to trade (for example, 0.01 lot, 0.1 lot, 1 lot). For beginners, starting with 0.01 lot is safest. Remember: larger lot size = higher risk and potential reward.

- Set Stop Loss and Take Profit (optional, but strongly recommended to manage risk).

- Click “Buy by Market” or “Sell by Market” (for Market Orders).

- After your order is executed, you can follow the progress of your trade in the “Trade” tab of MT5.

- To close your trade, go to the “Trade” tab, and click the “x” button next to your open position.

Step 8: Monitoring

Monitoring is the step in forex trading where you observe and analyze the market conditions to make informed trading decisions. Monitoring is an ongoing process, and it is one of the most critical forex trading steps for beginners.

Here are what you need to monitor:

- Track currency price movements.

- Follow economic news and events.

- Monitor the charts and technical indicators to identify potential trading opportunities.

- Keep track of your open positions and monitor their performance.

- Manage risk by monitoring stop-loss and take-profit levels.

- Evaluate trade performance.

Most forex trading platforms, including our platform, offer real-time charts, indicators, and news feeds. These platforms also allow you to set alerts and monitor your positions. Utilize such tools and monitor your trade to manage risk and enhance your trading skills and knowledge.

Practical Tips for Beginners: How to Manage Risk?

All trading and investing beginners must prioritize risk management because it forms their essential foundation.

Here are practical tips to help you navigate the markets safely:

- Start small and increase gradually,

- Use demo accounts,

- Set stop-loss order,

- Determine your risk per trade and stick to it,

- Avoid risking more than you can afford,

- Understand leverage and use it wisely,

- Have discipline and control your emotions.

Last Few Words

Congratulations! You’ve reached the end of one of the most detailed Forex Trading Guides out there. The fact that you’ve taken the time to read through every part of this beginner’s resource already puts you ahead of many newcomers who rush into trading without truly learning how to trade forex.

In this ultimate Forex Trading for Beginners guide, we’ve made it clear that long-term success in the market isn’t about luck—it’s built on education, strategy, and disciplined execution. To truly learn forex trading, you need to understand how the market works, choose the right broker (like ParamountMarkets), and get comfortable using a professional platform such as MT5.

We have covered the forex trading steps for beginners, from analysis to execution, risk management to trade closure, which are the skills you need to take your first confident steps and continue building on your journey.

It does not end there though; this is just how to start forex trading. With consistent learning, smart planning, and emotional discipline, you will be fully equipped to navigate the dynamic world of forex trading.

Start your forex trading journey today and let this market lead you to your financial aspirations!

FAQ

Should I use a demo account first?

Absolutely! Practice on a demo account before trading with real money.

Is forex trading safe?

While trading on forex comes with inherent risks, it is quite safe as you can plan your trade ahead and choose your broker before risking your money.

What is technical analysis?

Analyzing price charts and indicators to predict future price movements.

What is fundamental analysis?

Analyzing economic news and data to predict currency value.

Disclaimer: The information provided in this article is for educational and informational purposes only and does not constitute financial advice, investment recommendations, or an offer to buy or sell any financial instruments. Trading Foreign Exchange (Forex) and Contracts for Difference (CFDs) involves a high level of risk and may not be suitable for all investors. Leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite. You should not invest money that you cannot afford to lose.